Presidential $20,000 dollars of Potential Loan Forgiveness

In August of 2022, President Biden promised 10,000 dollars worth of debt forgiveness for those with student loans. This has been a campaign promise of his since before he was elected as the Democratic party’s nominee.

According to the White House, this student loan forgiveness program will offer $10,000 of student loan debt to those who have student loan debt, and $20,000 to those who have received the Pell Grant–a grant reserved for low-income undergraduates, or students attempting to get a bachelor’s degree. Those who will not be eligible are those with FEEL grant debt–a grant made by a private business that must be repaid, an annual income above $125,000, or married couples with a combined income of $250,000 or higher.

The legality of student loan forgiveness is currently to be carried out by the executive branch, as congress normally has its authority over fiscal policy. Some people point to the fact that it is congress that handles the budget and the president can not forgive student debt without congress’s approval for that express program. Though the legality of the action it has yet to be challenged in the judicial system.

This may affect President Biden’s re-election prospects, as this was one of the pledges he made while campaigning. On March 22, 2020, he first promised a minimum student loan forgiveness of $10,000 on Twitter, something which proved popular among young voters as he held about 60% of the votes from those between the ages of 18 and 29. Should President Biden choose to run again, this would affect both the midterm elections and the upcoming presidential election of 2024. Especially as debt forgiveness affects many young voters, who normally do not vote which makes their votes more valuable.

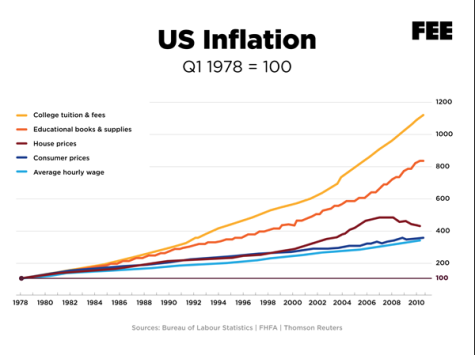

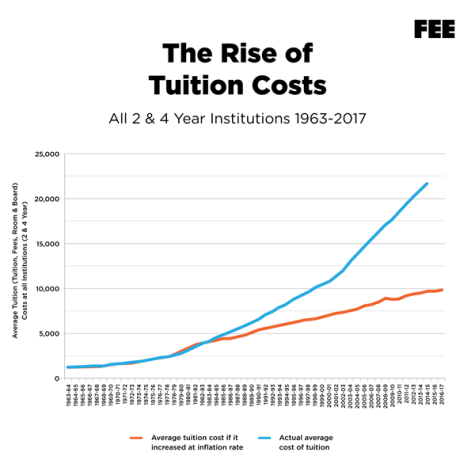

CC-BY-4.0 (Foundation for Economic Education)

In an interview with Dr. Lindsay Hoffman, a professor at the Biden Institute of Political Communication. Who worked with the President to open his Politics program at the University of Delaware, wrote, “So if in the next two years, this plan rolls out successfully, that could positively impact Biden’s chance of reelection. But again, that is a long way off in many voters’ minds”. To paraphrase a idea Dr. Hoffman explained, research suggests voter follow a tally model where voters, tally positive and negative of a politicians policy, then decide on the politicians with the most positive tally in their favor. This may not have a large effect on his election if president Biden is or is not able to fulfill his campaign promise.

Student loan forgiveness may have a particularly insidious effect on students, raising both the tuition cost and student debt. When questioning Mr. Stimac, the Golden Valley High School AP economics teacher, and Mr. Patey, the personal finance teacher at GVHS about student debt. Both saw a similar issue of students potentially taking on more debt, expecting the government to forgive the loans they took out. This was an early issue identified by Mr. Patey, who said, “I think it will affect them negatively. I don’t think that they will have to pay the entirety of their student loans in the future.”

Mr. Stimac added, “It might encourage people to make the more risky or more expensive option. If that’s the right decision I can’t say because everybody is different but I think it could encourage slightly more levels of risk and debt for students.” This may be making student loan forgiveness effects counterintuitive, by encouraging more spending.

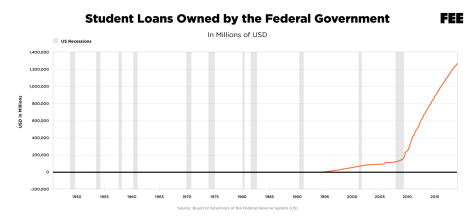

As 66% of graduate students borrow federal loans and only 63 percent of full-time students at all four-year institutions graduate within six years. Which leaves those students that take out loans and do not graduate in a harder place than they would have been if they had not gone to college in the first place. Which would be made worse by students taking out more loans expecting that some of their debt to be forgiven, as previous student debt has been forgiven which could set a precedent as the total student debt only grows.

CC-BY-4.0 (Foundation for Economic Education)

One reason the cost of college tuition is rising is that enrollment, and therefore demand, have been on the rise since 1950. The number of college seats has increased slower than the demand, so the price has increased.

This was highlighted later by Mr. Stimac, saying, “That some of the loan forgiveness is nullified because people are paying a high price” So that some of the money that is being forgiven allows for colleges to raise costs with less of a negative impact.

An example that Mr. Stimac gave of such a situation was “Just a few days ago the federal government decided that they were going to reinvigorate their tax credit for electric cars by 75,000 dollars almost that exact same time, the electric mustang ford announced the cost was going up by 75,000 dollars next year” which shows business taking advantage of the government funds to buy electric cars increasing to charge more. That highlights that though loan forgiveness comes from the right places, companies or most of those who can capitalize on it charge more so that they can have more money.

CC-BY-4.0 (Foundation for Economic Education)

If the loan forgiveness does go through despite the problems that it faces being enacted, it may harm students going into college. As it could encourage students, taking more on student loans which could cause tuition prices to increase. Despite the goal of student loan forgiveness to make college more affordable, it has increased the cost of tuition overall. A solution that is proposed to combat this issue is the funding of more institutions of higher education which would increase the number of seats available and lower the price of students.

Patrick M. Pixley is an editor for the Community News Team and senior at Golden Valley. The research of state, national and international news is fascinating and how it affects local and life for those around the world that he finds interests in. As a lot of the time people do not realize that news that doesn’t directly affect them even though it may indirectly affect them largely ways that are not immediately visible which he finds the most important part of journalism.

He finds that student journalism is important, as historically student journalism gives voice to those who do not have the ability to vote or affect politics in such a way that adults do not. Student journalism has challenged established forcing them to more into consideration, refine or change so that they adapt to the criticism. Patrick is excited that taking part in something that is critical of information allows me to challenge my opinions and world views.

Patrick is a born and raised Santa Clarita resident...